In 99 out of 100 cases, it takes many years to get rich. But since the media like to focus on a person who has become rich with a few Passive Income Ideas overnight, many have a wrong idea of how people get rich.

We all know that “becoming quick-rich”-systems never really work (otherwise they would not be called that) and mostly only the initiator benefits from it, but unfortunately it still works and the dream of wealth and financial independence is sold convincingly.

It is like playing gold or playing the lottery – only a few have become rich, but many with the sale of the equipment.

The basic problem with wealth is that it takes time. And people just don’t want to wait in our hectic and impatient world.

You want to get rich, immediately!

But if you decide to swim against the electricity and commit yourself to long-term asset structure, you will be almost unstoppable.

You just have to do one thing: increase your pure assets every year.

The best way to achieve this is to have several independent sources of income. If you should only have one or two sources of income at the moment, like almost everyone, take it as an incentive to widen the base.

With a little creativity, resistance, and, above all, patience, you will reach the goal one day. But that doesn’t happen overnight.

If you are really serious about building up assets over time, you will achieve this goal because you control your behavior and focus on your goal.

Of course, any success you have will obviously result in additional income. Therefore, you must remember to keep track of all transactions and set aside enough to pay your tax bill.

There are all sorts of tools available—many for free. For instance, a tax bracket calculator is incredibly helpful, along with expense tracking apps and invoice creators.

Moving on, The following Passive Income Ideas will gradually increase your net assets if they are implemented correctly and well.

5 Passive Income Ideas

Write and Sell Books

Let’s start with something that you can produce almost free of charge. In contrast to a website, a book is something that you can do without any financial expenses. It only requires your time, your commitment, and a computer.

Of course, buying a computer costs money, but we assume that you have it available. The time resource is the initial investment and does not cause any direct costs.

Your own book not only increases your income but also your awareness. If you have written and published a good book, you cancel yourself from the people who have not written a book.

You can then imagine this and that book as an “author of” and apply it accordingly.

But much more important: A book generates income when offered on corresponding marketplaces. In the age of Apple, Amazon, and Co. this is easy.

The jumping point is that it takes time to build up and become known to a brand. And it is important to hit the nerve of the reader and offer added value. You should also publish several books, so you increase the chances of having a successful one.

Offer Online Courses

People always want to learn something. In our always fast-moving society, lifelong learning is a must.

It doesn’t matter whether it is about building an online business, writing, cooking, crafting, etc. Learners always have a need for support and specialist knowledge. And people are happy to pay for good information that offers you problem-solving.

If you have specialist knowledge, it is best to pass it on in an online course. And why? Because you only have to create it once and, if necessary, occasionally update it. Then you can sell it for years. This comes very close to a definition of an almost perfect passive income.

But it’s not just about bare numbers. Many successful examples show that we are willing to spend money on knowledge. Because people buy something because they believe that it helps them.

Online courses also help you to increase your authority and your awareness of your topic. The presumption of competence also increases with the level of awareness and increases the chances of income.

There are many prominent examples of people who cover the complete value chain with books, television programs, and also online.

The creation and maintenance of an online course require a higher initial investment time and there are also costs for a professional platform. For this, the contribution margins are significantly higher than, for example, with an e-book.

Develop Digital Products or Services

Online courses and e-books are digital products. However, the range of digital products is far larger.

For example, very popular are

- The creation and sale of an app

- The creation and sale of stock videos, photos, and so on.

- The creation and sale of templates

- The creation and sale of a newsletter

For these application examples, there are a variety of successful implementations on the network. The advantage is that most digital products can be manufactured themselves and, apart from occasional updates and changes, they are quite self-sufficient.

The earning opportunities are almost unlimited. As long as the product is bought, deserves it.

Buy Rented Real Estate

Another, very popular example of a passive source of income. The achievement of rental income from the foreign property.

A very popular form of investment is the land of tenants and constantly increasing real estate prices.

The current decline in real estate prices does not matter in the long term. Purchase opportunities will probably result in the too-distant future.

However, investing in a property requires a not inconsiderable use of equity. Thus, this idea of a passive income is intended for the phase, where you already have some profitable other sources of income.

A real estate investment is also a long-term investment. Exaggerations, as they have taken place in the USA or China, in which real estate, due to constantly increasing market prices, have been traded wildly, do not correspond to the meaning of an additional passive income.

Invest in Index Funds / ETFs

Many studies have shown it, only very few active fund managers make the market sustainably. And after fees and sales costs, the comparison looks even worse.

So what to do? The solution is obvious. The purchase of passive managers index fund is cheaper and the investor performs as well or badly as the market.

What does that have to do with passive income?

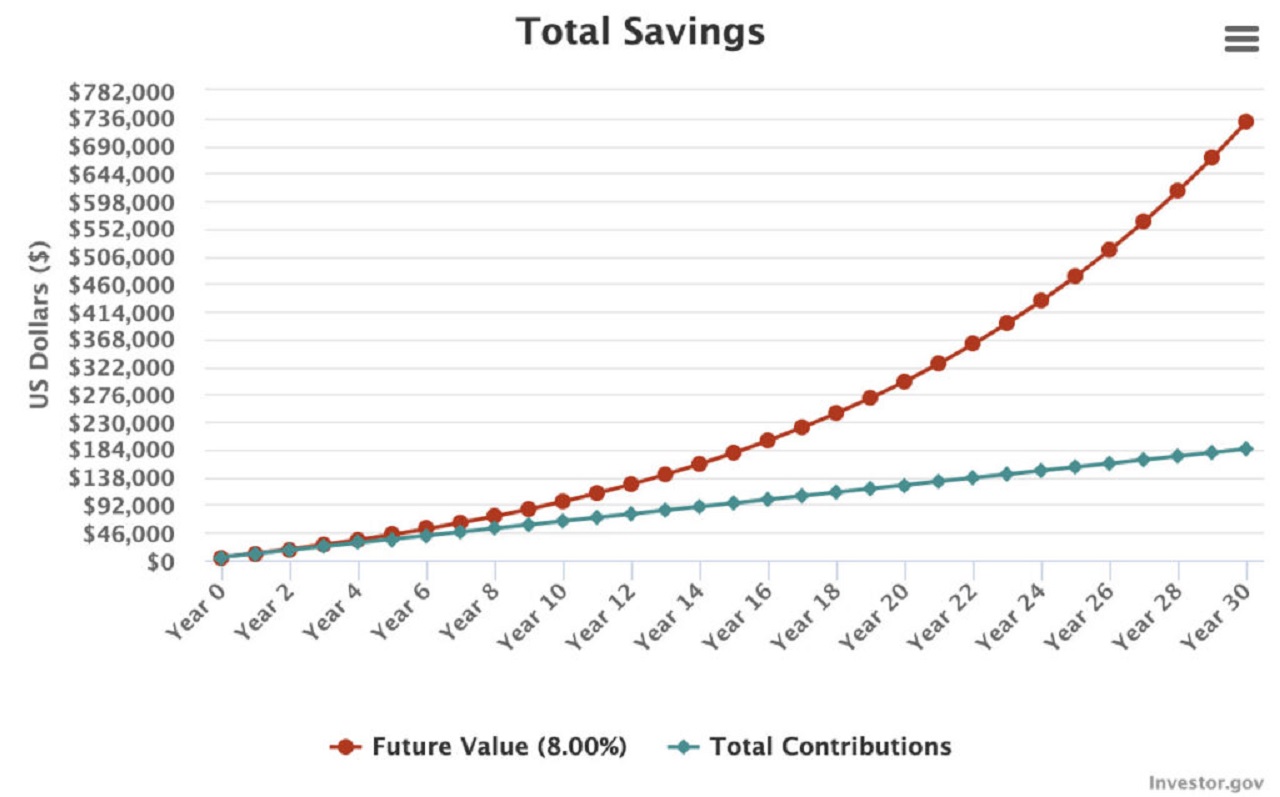

In the event of a constant investment (savings plan) into an index fund over a long period of time, high amounts can come together. These would not only be an additional passive source of income but also probably a significant cornerstone for attractive total assets.

The “power” of the compound interest effect becomes clear, especially over long periods of time.

With an initial investment of USD 5,000 (the currency is irrelevant for the example) and a monthly savings rate of USD 500 over 30 years and an assumed annual increase in value of 8 % p.A. (without any control and fees)

The example can be adjusted as desired. It shows how important and profitable a long-term financial investment can be.

To get rich you have to stay on the ball

All ideas presented are not magic tricks that will make you rich overnight. Rather, they require patience and perseverance.

In order to be able to harvest the fruits of a successful asset structure in the end, only some good ideas, hard work, and, as always, a happy hand in implementation are required.

Because once you have introduced the systems, you don’t have to use a lot of time and effort. That gives you the energy for other things. I wish you success.