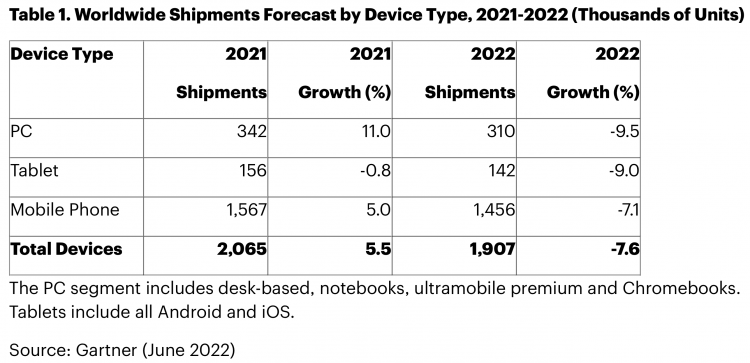

The big picture: The PC industry saw significant benefits from the sudden shift to remote work and study in 2020 and even squeezed a bit more growth in 2021 as manufacturers were left with a massive backlog of orders to fulfill. Analysts expect PC sales to drop to levels slightly above pre-pandemic this year, but that shouldn’t surprise anyone.

After two chaotic years, the global PC market conditions started normalizing in Q2 2022. For a brief moment, manufacturers breathed a sigh of relief after experiencing multiple shocks due to component shortages, increasing material costs, and other logistics headaches.

However, market analysts at Gartner believe the industry should brace for a 9.5 percent drop in global PC shipments this year as they expect consumer demand to drop by 13.5 percent compared to last year. Business PC demand will see a slightly lower dip of only 7.2 percent, but that’s still something that could hit the bottom line of OEMs like Dell, HP, Lenovo, and others.

The forecast is even more gloomy in the European, Middle East, and Africa regions (EMEA). Gartner says consumer PC demand in the EMEA could see a 14 percent decline this year. They project tablets and smartphone sales to see dips of around seven percent. Samsung and other OEMs reduced their component orders this month due to swelling inventories, but this could be a temporary measure.

Gartner senior director Gartner Ranjit Atwal says a perfect storm of factors is forming from the Russia/Ukraine conflict, high inflation, currency fluctuations, and more. Furthermore, OEMs have mostly covered much of the demand created by the shift to remote work. The Chromebook market, in particular, looks set to lose a lot of steam this year.

According to Atwal, Chromebook sales surged towards the end of 2020, but that success was short-lived. Education buyers snapped 11 million units in a single quarter, but demand gradually dropped through 2021. This year, Chromebook sales are expected to take a 30 percent hit, which is bad news for Samsung, Acer, HP, Lenovo, and Dell.

Component sales also face a downward trend, with everyone waiting for next-generation hardware from Intel, Nvidia, and AMD. Now that GPU prices have returned to somewhat normal levels, demand for motherboards is waning as many consumers no longer see the appeal of motherboard + GPU bundles, and some of them simply don’t need to upgrade just yet.

That said, the situation may change in the coming months as an oversupply of DRAM could make DDR5 pricing more tempting to people looking to jump to Intel’s LGA 1700 platform or AMD’s AM5.

Image credit: Olena Sergienko

Source by www.techspot.com