Cryptocurrencies are often criticized for being bad for the planet. Every year, bitcoin mining consumes more energy than Belgium, according to the University of Cambridge’s Bitcoin Electricity Consumption Index. Ethereum’s consumption is usually pegged at roughly a third of Bitcoin’s, even if estimates vary. Although some 39 percent of the energy going into bitcoin mining comes from renewable sources, according to a 2020 Cambridge report, the industry’s carbon footprint is generally regarded as unacceptable. According to a 2019 study, bitcoin mining belches out between 22 and 22.9 million metric tons of CO2 every year.

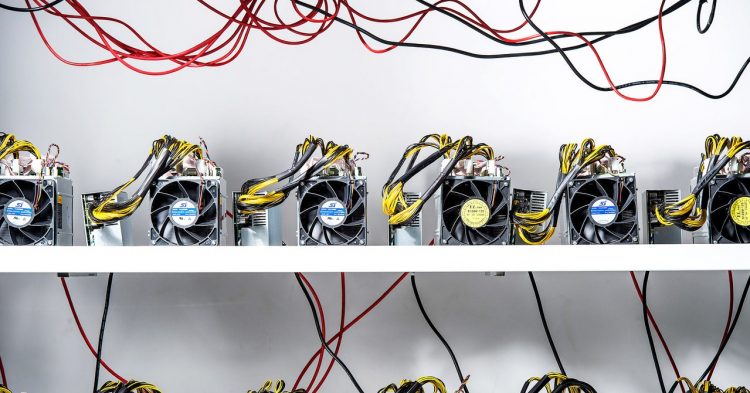

The problem is that specialized computers powered by eye-popping amounts of electricity are needed to process and verify transactions of cryptocurrencies like bitcoin or Ethereum’s ether on blockchains, via a process called proof-of-work mining. In this system, thousands of computers all over the world (but mostly in the US, China, Kazakhstan, and Russia) vie with each other to solve a mathematical puzzle and earn the privilege of appending a batch of transactions, or “block,” to the ledger. The miner who prevails wins a crypto reward.

Most Bitcoin advocates will tell you that proof-of-work mining is essential to keep the network secure, and would never dream of tampering with something first conceived by the currency’s pseudonymous creator, Satoshi Nakamoto. But Ethereum is on the verge of a monumental change that will substantially reduce its environmental impact.

Ethereum, launched in 2015 by a 21-year-old whiz kid named Vitalik Buterin, is about to swap proof-of-work mining for an alternative system known as proof of stake, which does not require energy-guzzling computers. The Ethereum Foundation, a research nonprofit that spearheads updates and ameliorations to the Ethereum blockchain, says the shift will reduce the network’s energy consumption by 99.5 percent. The big switcheroo is known as the Merge—and it is slated to take place on September 14.

What Is the Merge?

The Merge hinges on the fusion of Ethereum’s current proof-of-work blockchain with the Beacon Chain, a proof-of-stake blockchain that was launched in December 2020 but so far has not processed any transactions.

A couple of upgrades, scheduled to launch over the next few weeks, will lay the groundwork for a segue from one chain to the other. Justin Drake, a researcher at the Ethereum Foundation, says the way the process has been structured can be compared to a car switching from an internal combustion engine to an electric one. “How do we do that? Step one: We install an electric engine in parallel to the gasoline engine. And then—step two—we connect the wheels to the electric engine and turn off the gasoline engine. That’s exactly what’s going to be happening at the Merge,” Drake says. “We’ve had this parallel engine of the Beacon Chain for a year and a half—and now the old ‘gasoline’ proof-of-work engine is going to be shut off.”

After years of delays, the Ethereum community is positive that the long-awaited shift will finally happen, following a successful dry run carried out on a test blockchain, called the Goerli chain, on August 10. The fact that Buterin has a book titled Proof of Stake coming out in September is probably a coincidence.

How Will Ethereum’s Proof of Stake Work?

Talking about proof of stake is a bit like talking about French cheese: There are myriad varieties—with hundreds of cryptocurrencies claiming to use some version of the process. At its most basic, however, proof of stake is predicated on the idea of securing a network through incentives rather than hardware.

In this scenario, you don’t need an expensive mining computer to partake in the network: You can use your laptop to put down a “stake”—a certain amount of cryptocurrency locked in the network. That gives you the chance of being selected, usually via a random process, to validate a certain block and earn crypto rewards and fees. If you try to game the system, for instance by doctoring a block, the network will punish you and destroy, or “slash,” some or all of your stake.

Source by www.wired.com