As the world worried about Russia’s blockade of Ukrainian grain exports in the Black Sea in late June, Vladimir Putin had a different trade route on his mind. Addressing leaders of nations that sit on the Caspian Sea, the Russian president spoke of a “truly ambitious project” as the centrepiece of Moscow’s efforts to “improve the transport and logistics architecture of the region”.

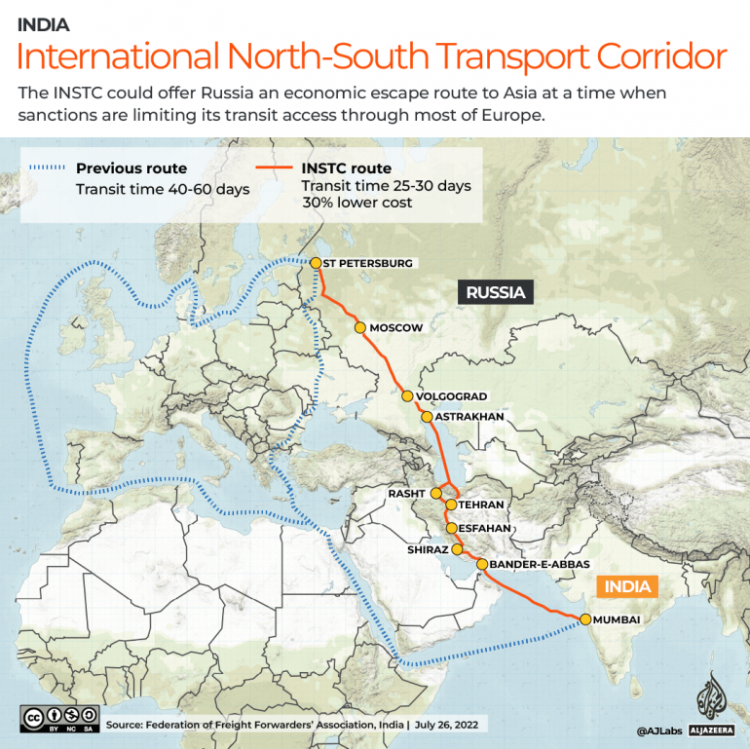

For more than two decades, the International North-South Transport Corridor (INSTC) — a 7,200-kilometre (4,474-mile) network of railroads, highways and maritime routes that connects Russia and India through Iran — has been little more than a pipe dream. But this old wine is finally ready to be uncorked by Moscow, Tehran and New Delhi, according to analysts. A rare confluence of geopolitical and economic incentives is turning the route into a potentially vital economic escape pathway for Moscow as tough Western sanctions deny the Kremlin access to European markets.

In June, Iran announced the first-ever pilot transit of goods from Russia to India using the INSTC, through the port of Bandar Abbas on the Strait of Hormuz. The two containers of wood laminate have since been followed by the shipment of at least 39 more containers headed from Russia to India’s Arabian Sea port of Nhava Sheva in July.

This is just the start, said Vaishali Basu Sharma, a former consultant at India’s National Security Council Secretariat. Earlier this month, RZD Logistics, the largest multimodal transport operator in the former Soviet nations and the Baltics, launched a new container train service along the INSTC. And by 2030, the INSTC corridor is expected to have the capacity to transport up to nearly 25 million tonnes of freight each year — 75 percent of the total container traffic between Eurasia, South Asia and the Gulf.

“These are the new routes east, and Moscow is very serious about getting these put in place, especially as EU sanctions are expected to remain — even after the conflict with Ukraine is over,” said Chris Devonshire-Ellis, founder of Dezan Shira & Associates, a pan-Asian business and investment consultancy, to Al Jazeera.

The logic behind the INSTC is simple. Historically, the absence of a developed land route has meant that freight from India to Russia has had to cross the Arabian Sea, Red Sea and Mediterranean Sea, then go around Western Europe and finally pass through the Baltic Sea to reach Saint Petersburg. Dry runs by the Federation of Freight Forwarders’ Associations in India have shown that the 7,200-km INSTC — which cuts through Central Asia, the Caspian Sea, Iran and finally the Arabian Sea — reduces travel time from 40-60 days to 25-30 days, and cuts costs by 30 percent.

For India, the route is also strategic: It offers access to Central Asia and Afghanistan, bypassing arch-enemy Pakistan. In 2016, India committed to an $85m investment and a $150m soft loan to develop berths at Iran’s Chabahar port during Prime Minister Narendra Modi’s visit to Tehran. New Delhi wants the INSTC to include Chabahar, a likely possibility.

Changing priorities

Despite this allure, the INSTC was not a priority until now for Russia and India, say experts. Europe was the Kremlin’s economic focus, with the European Union contributing more than a third of Russia’s trade in 2020.

“Most of Russia’s supply chains are built to cater to Europe,” Gulshan Sachdeva, a professor at the Centre for European Studies in New Delhi’s Jawaharlal Nehru University, told Al Jazeera. India, too, has largely focused on expanding trade with the West, China and Southeast Asia over the past two decades. Western sanctions on Iran further complicated the prospect of investing in the INSTC.

Now, that landscape has changed. In June, Lithuania imposed a transit ban on sanctioned goods headed for Russia’s Baltic enclave of Kaliningrad, only reversing its decision after the EU stepped in to clear the way for the cargo to travel. Earlier this month, the Moscow Times reported that Kazakhstan was proposing a law that would bar the transit of EU-sanctioned goods into Russia. All of this makes it “extremely important for Russia to develop new supply chains and enhance others,” said Devonshire-Ellis.

For years, the near-stagnant levels of India-Russia bilateral trade — which hovered between $8bn and $11bn annually — also served as a check on the ambitions of potential investors in the INSTC, said Sachdeva. “The question was: If that’s the limit of the volume of trade, are massive investments in the corridor worth it?”

India’s imports from Russia jumped in April and May on the back of a surge in purchase of Russian crude [File: Olivier Matthys/AP Photo]

India’s imports from Russia jumped in April and May on the back of a surge in purchase of Russian crude [File: Olivier Matthys/AP Photo]

There, too, the past few months have dramatically bolstered the argument for the corridor. Over April and May, India’s imports from Russia grew by nearly 272 percent — crossing $5bn in just two months — compared with the same period in 2021. The biggest chunk of that comes from a surge in India’s purchase of Russian crude since the start of the war: $4.2bn over April and May. But India also ramped up its imports of Russian fertilisers by nearly 800 percent in those two months. That steep increase in trade serves as a proof of concept for the INSTC, said Sachdeva. “Both politically and economically, the stars have finally aligned for the INSTC,” he said.

US pressure

That alignment could still face disruptions. New Delhi, already at odds with Washington and Brussels over its increased imports of Russian oil, is likely to witness new pressure from the West if it doubles down on the INSTC, said experts.

But there is growing weariness in India over complying with Western demands, suggested Sharma, the national security analyst. India had acted according to United States requests in the past to stop purchasing oil from Venezuela and Iran — only to now find that Washington itself is allowing Venezuelan crude to reach Europe, she said. The increased trade between India and Russia and the focus on the INSTC show that “emerging economies are finally breaking the hegemony of financing structures created by developed countries,” Sharma told Al Jazeera.

There are also limits to how much Washington can pressure India, said Velina Tchakarova, director of the Austrian Institute for European and Security Policy. “The US needs India more while facing the DragonBear [a reference to the deepening China-Russia coalition] than India needs Washington while facing China in the Indo-Pacific,” she said to Al Jazeera.

Other challenges persist. The sanctions on Russia and Iran continue to make investments in the INSTC risky. The route is still a patchwork of several independently run rail, road and maritime projects, without a single operator in charge, said Sharma.

Still, Devonshire-Ellis said, other developments suggest that the INSTC is now a priority not just for Russia, India and Iran, but also for other nations: A ‘Middle Corridor’ that Georgia, Azerbaijan, Kazakhstan and Turkey signed up for this year is an example. “The regional desire is now there to make it work,” he said. “It is already happening.”

Source by www.aljazeera.com