The top seven job search engines have been hitting new monthly use rates since March, according to data from web-metrics provider Apptopia.

After a period of ebb and flow, numbers have been climbing steadily for the past year, according to Apptopia’s latest data. Average daily active users for the month of June have so far grown 57% year-over-year.

“What’s super interesting to note is that no month this year has hit a record for monthly active users. This means that while the apps are adding new users, users who already have the apps are playing a large role here, meaning engagement has increased,” Adam Blacker, Apptopia’s director of content and communications, said in a blog post.

Most of the job search download spikes occur on Fridays as employees appear to be waiting for the weekend to start their job hunts. “That, or as another analyst on the team told me, layoffs happen on Fridays,” Blacker said.

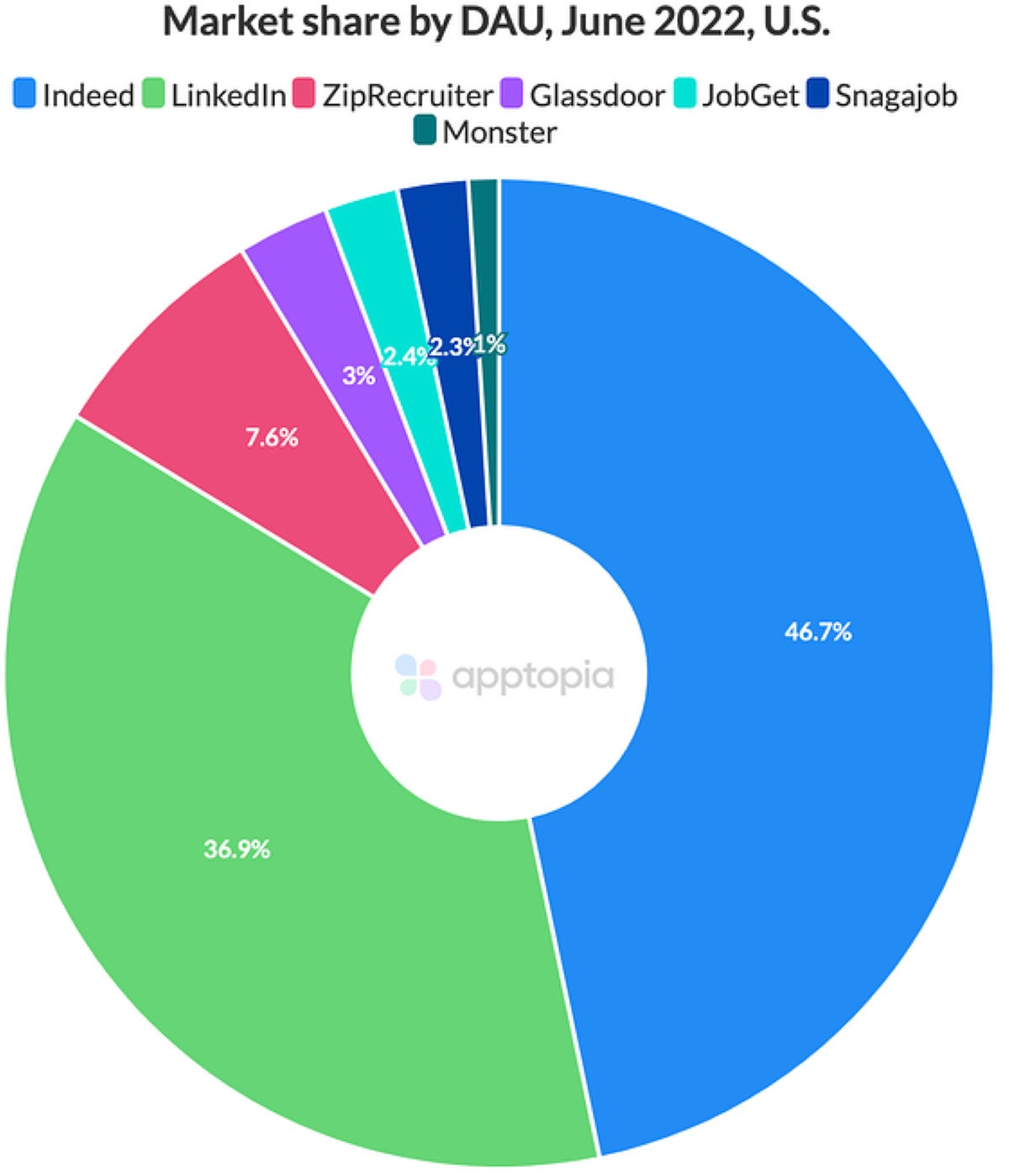

Year-to-date, the top three apps by both downloads and daily active users are Indeed, LinkedIn, and ZipRecruiter. ZipRecruiter is growing the fastest with its daily active users up 37% this year. Only Monster and Snagajob have seen a decrease in daily active users this year (down 7.3% and 16.5%, respectively).

LinkedIn is the only search app among the seven tracked by Apptopia that generates revenue via in-app purchases, and it hit an all-time high for users in the US. It’s seen a 157% increase over the past year.

Even as job searches are on the rise, some employers are reportedly pulling back job offers to recent graduates who had not formally accepted or who had not yet started work.

“On Wall Street, recruiters have stopped scheduling interviews,” M. Victor Janulaitis, CEO of management consulting firm Janco Associates, wrote in a report released last week.

Multiple economists and financial services firms have predicted the US could face a recession over the next year. Janco Associates weighed in on what could happen to IT sector jobs if that happens.

“When CFOs and CEOs respond to a recession they traditionally look in two areas,” Janulaitis said. “The first is on ‘new’ hires. They minimize the number of [full time employees]. The second is focusing on eliminating high-cost positions and support costs. The average compensation for IT pros is close to $100,000 — those positions will be targeted.”

The first full-time positions to go in a recession are usually contractors and consultants, then low-skill positions; that’s followed by eliminating programs that do not have an immediate impact on day-to-day performance and an enterprise’s key performance indicators, Janulaitis said. Other cost reductions include the elimination of training, offsite travel, fringe benefits such as bonuses, and salary increases.

With an ongoing shortage of IT pros, any high earners who are laid off should have little trouble finding new jobs. “Even during the pandemic, these individuals were still in high demand,” Janulaitis said.

Janco forecasts demand will remain high for IT pros for the next two quarters, but could slow in the first two quarters of 2023 if a recession takes hold.

Currently, there are still more than 100,000 unfilled positions for IT pros due to a lack of qualified candidates; that figure has remained level for several months, Janulaitis noted.

So far this year, the IT sector has added 91,000 new job openings and by the end of the year, that number is expected to more than double to 191,000, according to Janco Associates.

Last month, tech firms added workers for the 18th consecutive month and employer job postings for tech occupations reached a new, according to an analysis of the latest employment data by a nonprofit association for the IT industry and workforce.

Technology companies added 22,800 net new workers in May, and through the first five months of 2022 employment in the industry rose by 106,700 positions; that’s 69% ahead of the same period in 2021, according to an analysis of the US Bureau of Labor Statistics (BLS) jobs report by industry association CompTIA.

That tight labor market, coupled with the ongoing effects of the Great Resignation and the rising risk of recession, is likely fueling the job-search surge — especially for people who work at marginal companies that could flounder.

“So, they may be looking for a more stable company to work for as insurance against possibly troubling financial times,” said Jack Gold, principal analyst at J. Gold Associates, LLC..

Another explanation for the spike in job searches could also be that some companies are insisting employees return to the office, and rather than fight the edict, workers simply look for more suitable accommodations, Gold said.

According to Apptopia, the number of reviews posted in top job apps with the keyword “remote” in them has increased 900% in 2022 compared with all of 2019.

“2020 was when we saw the first large jump, but 2022 is going to see an even larger jump,” Blacker said. “Many of these reviews are asking the app publishers to be able to sort open jobs by levels of remoteness; partially remote, local but remote, fully remote, etc.”

Several high profile companies have announced return-to-office policies, including Tesla and Apple. And while the job market remains tight, several large companies, including Salesforce, Twitter and Meta, have slowed the hiring of new staff amid rising inflation and market uncertainty; other companies have cut jobs entirely.

One other explanation for the spike in job searches may be rising inflation, and particularly the high cost of gas, Gold said. It could be spurring some to seek more lucrative jobs to stay ahead of the inflationary pressure on their paychecks.

“And they need to do so now, while the job market is still very good, since it may not be in a few months. Similarly, there may be some who have already been hit by layoffs, which are picking up steam, and are needing to find a landing spot,” Gold said.

Copyright © 2022 IDG Communications, Inc.

Source by www.computerworld.com